Your credit score impacts my any aspects of your life, probably many more areas then you expected, from the interest rate you pay on a loan to your ability to get a job, they are all tied to your credit score. Know your credit score is very important As a result, there are many companies that look to help individuals get access to their credit scores. One of those companies is Credit Karma.

What is Credit Karma

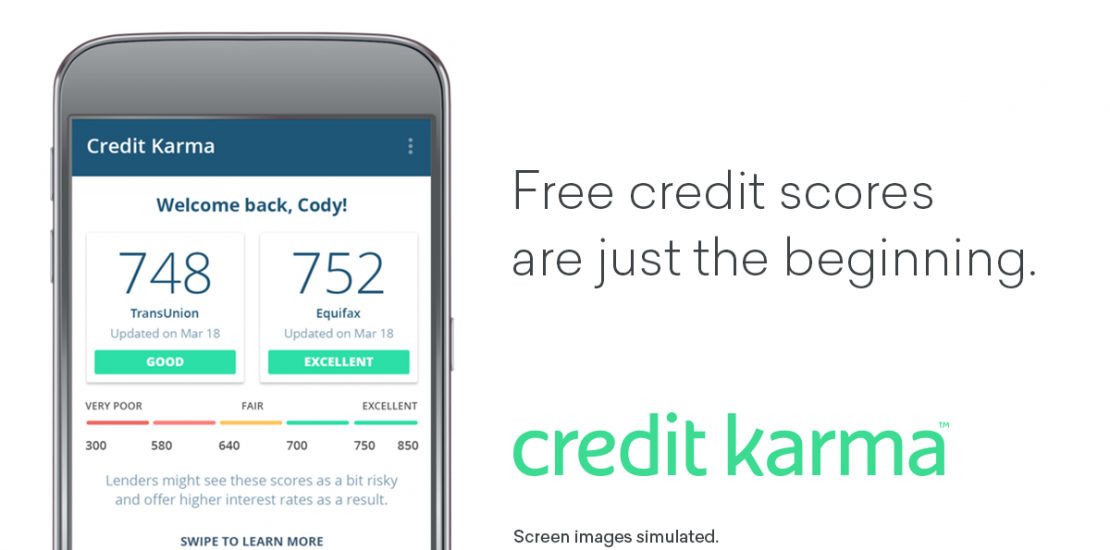

You may have seen their TV ads, the guy making breakfast and his wife says she is going to check their credit score and then he flips out, worried that his wife checking their credit score would negatively impact their credit score. Yep, that’s a Credit Karma ad, but what is Credit Karma. Credit Karma is a multinational personal finance company which empowers its users with free credit scores, reports and insight into their credit scores. The company was founded in 2007 by Kenneth Lin, Ryan Graciano and Nichole Mustard. The company currently employees over 700 people that help their users with everything from obtaining their credit scores to tax preparations.

What does Credit Karma offer? Does Credit Karma Only check credit scores?

So while they do promote heavenly on the aspect of checking your credit score, as that is one aspect of Credit Karma. Think of Credit Karma as a financial sidekick, they also over credit monitoring, reports and credit insights, they also have resources available for users to obtain and refinance loans, help with taxes and other financial issues that people run into. Which is why Credit Karma is more than just checking credit scores.

What does Credit Karma Cost

Credit Karma is free to use, they provide an individual’s credit scores for free. So you may be wondering If they allow users to obtain their credit scores for free how do they make money? Do they sell your personal information? To answer those questions, no they don’t see your personal information. They do make money by cross promoting other products to their users based on their credit score. For example, if you have a low credit score they may promote you offers that will help clean up your credit history and boost your credit score. If you have a good or great credit score, they may offer you credit scores that offer great interest rates for individuals with good credit scores. In the process they collect a commission on the sale, which is how they are able to offer the users the free credit scores and monitoring that they provide.

Is Credit Karma worth it

So you may be wondering if the service is free, how is it not worth it. Some users may find their cross promoting of products and services annoying and given how many other credit card providers offer free credit score reporting, many people may not think its worth signing up for the Credit Karma service. If you are looking just to obtain your credit score, you could likely get that from one of your credit cards you hold. If you don’t receive your credit score from one of your credit cards, or are looking for more help with your finances then this service is definitely worth it.

Is Credit Karma safe?

Yep, Credit Karma is safe. When you hear of someone offering something for free, people are usually suspicious and rightfully so in todays time and many people like to throw the word scam around when something doesn’t go their way. Credit Karma is Safe and no they are not a scam. They don’t even require that you provide a credit card, they don’t prebill you, and they don’t charge you to use their service.

How to Login to your Credit Karma Account

The Credit Karma login page is your doorway to all your account information. Therefore, it is very import that you keep your information secure, that you don’t use the same login information as you have on other websites. The office page for your Credit Karma Login can be found over here Credit Karma Login Additionally, if for some reason you think that the login page does not look correct, do not enter your login information. Instead go to google and type in “Credit Karma Login” and ensure that the link is to a their page.

Alternatives to Credit Karma

One appealing aspect of Credit Karma is the ability to combine multiple services offering into one place. As a result, if you are in the market for a number of different financial products, you can get them all from Credit Karma, you’ll just have to provide them with your information one time instead of having to join multiple sites. However, if your looking for a credit report or compare interest rates on credit cards there are other sites that will offer that for you. Listed below are alternatives to what Credit Karma offers.

Credit Report – In 2003 congress passed a law that allows individuals to obtain a free credit report. The law states that you can obtain once a year a free credit report from each reporting agency In order to get your free credit report visit AnnualCreditReport

Credit Scores – If your looking to find out what your credit score, you have a number of options. Many credit cards provide you that information on your statements. If you don’t receive it you can obtain your credit score from FreeCreditScore.com

Credit Card Comparison – One of the reasons people obtain their credit scores to find out if they should be looking for better rates on their credit cards and other loans they have. If you are looking to comparison shop for credit cards that a look at WalletHub

These are 3 alternatives to what Credit Karma offers, if your looking for something specific as in a free credit report or to comparison shop on credit cards.

Conclusion

Credit Karma is a helpful took that helps users stay informed on their credit standing. It allows their users to save money by using their credit information in order to obtain better offers for them. They also offer many other features to help their users such as tax preparations. One of the best features of their offerings are totally free for users. As a result, their users who take advantage of them can really save money. If your looking to save money visit Credit Karma’s website.